42 the formula for depreciable cost is

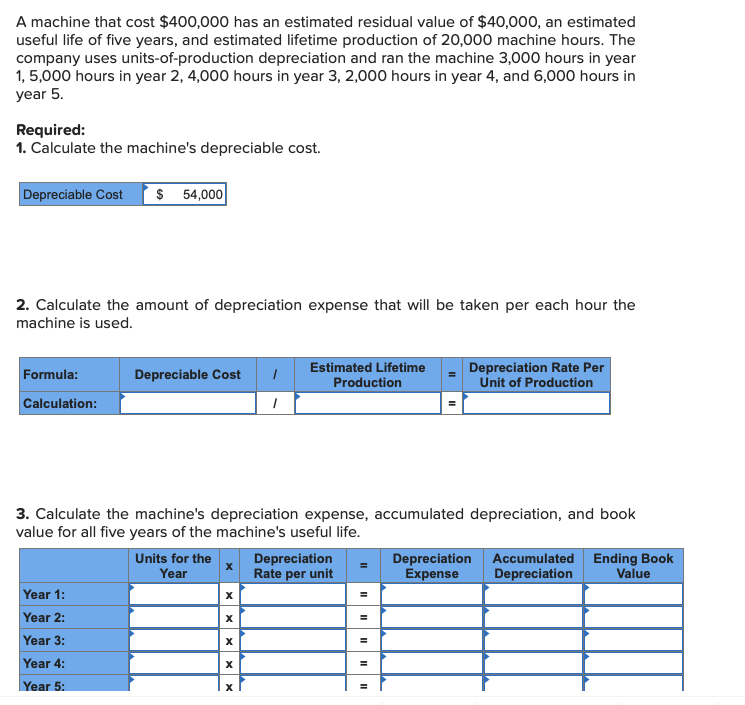

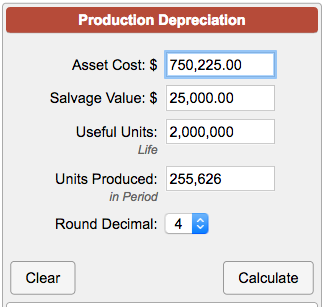

Depreciation Formula | Examples with Excel Template Under the unit of production method, the formula for depreciation is expressed by dividing the difference between the asset cost and the residual value by the life-time production capacity, which is then multiplied by the no. of units produced during the period. Mathematically, it is represented as Depreciable Base = Asset Cost - Salvage Value Includes formulas and example. Depreciation per unit and depreciation for a period. The depreciable base is given as extra information. Depreciable Base = Asset Cost - Salvage Value.

Depreciation of PP&E and Intangibles (IAS 16...) - IFRScommunity.com Depreciable amount is the cost of an asset less its residual value. This method is used for depreciating assets subject to increased technical or commercial obsolescence. There are a few approaches to the mechanics of this method.

The formula for depreciable cost is

Depreciation Formula | Calculate Depreciation Expense Guide to Depreciation Formula. Here we discuss calculation of depreciation amount using various methods along with examples & downloadable Depreciation Expense Calculation Examples. You can download this Depreciation Formula Excel Template here - Depreciation Formula Excel Template. Types of Depreciation Methods: Formulas, Problems, and Solutions An asset is depreciable if it has a determinable useful life of more than one year in business or something to produce an income. a. Adjusted Cost Basis is the asset's original cost basis used to compute depreciation deductions adjusted by allowable increases or decreases. (Get Answer) - 97. The formula for depreciable cost is A. initial cost... 101. Computer equipment was acquired at the beginning of the year at a cost of $65,000 that has an estimated residual value of $3,000 and an estimated useful life of 5 years. B. If using the units-of-production method, it is possible to depreciate more than the depreciable cost.

The formula for depreciable cost is. Depreciation of Assets | Boundless Accounting The formula to calculate depreciation expense involves two steps: (1) determine depreciation per unit ((asset's historical cost - estimated salvage Under this method, annual depreciation is determined by multiplying the depreciable cost by a series of fractions based on the sum of the asset's useful life... 4 Ways to Calculate Depreciation on Fixed Assets - wikiHow Divide the depreciable cost by the asset's lifespan to get the depreciation.[3] X Research source The asset that you purchased has an expected lifespan just like anything else (your personal computer, for example, is something that you probably don't expect to use for more than a few years). Depreciated Cost - Overview, How To Calculate, Depreciation Methods Depreciated cost is the remaining cost of an asset after reducing the asset's original cost by the vehicles, computers, equipment, and computers are some other examples of depreciable assets. The formula is shown below: The acquisition cost refers to the overall cost of purchasing an asset... Depreciation of Operating Assets Depreciable cost equals an asset's total cost minus the asset's expected salvage value. Another way to describe this calculation is to say that the asset's depreciable cost is multiplied by the straight‐line rate, which equals one divided by the number of years in the asset's useful life.

Depreciation Methods | Formulas and Examples Depreciable amount equals historical cost minus salvage value. Continuing with the example above, let's assume that instead of using the straight-line method or the double-declining balance method, the company wants to depreciate the airplane based on the flights it takes in each year. › businesses › cost-segregation-atgCost Segregation ATG Chapter 6 2 Change in Accounting Method ... A change in the treatment of an asset from non-depreciable or non-amortizable to depreciable or amortizable, or vice versa, Treas. Reg. § 1.446-1(e)(2)(ii)(d)(2); A correction to require depreciation in lieu of a deduction for the cost of depreciable or amortizable assets that had been consistently treated as an expense in the year of purchase ... Depreciable Cost Therefore, the formula for the accumulated depreciation of an asset's value is While discussing the assets of depreciation calculation, the facet of depreciable cost plays a big role. Defined as an asset's cost which is susceptible to be depreciated with time it is, in effect, the same as the asset's... What Is Depreciation? and How Do You Calculate It? | Bench Accounting Formula: (asset cost - salvage value) / units produced in useful life. How it works: Using the formula above, you What it is: The Modified Accelerated Cost Recovery System (MACRS) is the depreciation method generally required on a U.S. tax return. That's the depreciable value of the house.

salimian.webersedu.com › IEGR350 › pdfEECE 450 — Engineering Economics — Formula Sheet B= initial (purchase) value or cost basis S= estimated salvage value after depreciable life dt= depreciation charge in year t N= number of years in depreciable life Book value at end of period t: BV t = B −∑ = t i di 1 Straight-Line (SL): Annual charge: dt = (B – S)/N Book value at end of period t: BV t = B − t ×d Sum-of-Years ... › en › revenue-agencySelf employed Business, Professional, Commission ... - Canada Since land is not depreciable property, he has to calculate the part of the expenses connected with the purchase that relates only to the building. To do this, he has to use the following formula, explained under the heading Land. $75,000 ÷ $90,000 × $5,000 = $4,166.67 What is the formula for depreciation? - Wikipedikia Encyclopedia ? Straight Line Depreciation Formula We can place these figures into the following formula: (Asset cost - salvage value)/Useful lifespan of asset. Purchase cost of $60,000 - estimated salvage value of $10,000 = Depreciable asset cost of $50,000. 1/5-year useful life = 20% depreciation rate per year. Depreciable Cost: What Does Depreciable Cost Mean? The depreciable cost is the cost of an asset that can be depreciated over time. It is equal to acquisition cost of the asset, minus its estimated salvage value at the end of its useful life. Businesses depreciate assets for both tax and accounting purposes. What Is Depreciable Value?

Formula for depreciable cost? - Answers Earn +20 pts. Q: Formula for depreciable cost. Overhead cost is part of total cost and not different from total cost as formula is as follows: Total cost = material cost + labor cost + overhead cost.

Depreciation Turns Capital Expenditures into Expenses Over Time "Depreciable cost" is the maximum part of "Original asset cost" subject to depreciation. "Residual value" (or "Salvage value"), in most cases, is what owners expect to receive for the asset after full depreciation. In practice, accountants normally derive an asset's original "depreciable cost" from...

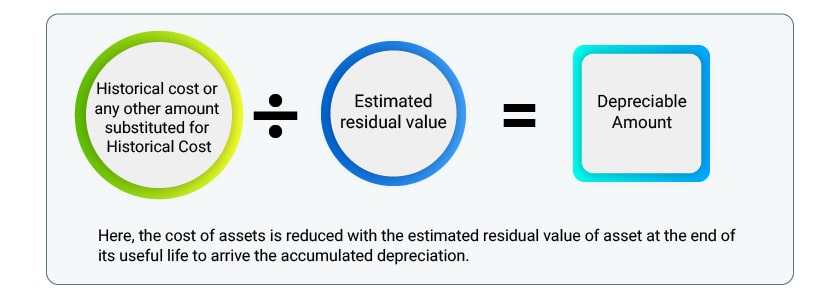

Depreciable cost definition — AccountingTools Depreciable cost is the combined purchase and installation cost of a fixed asset , minus its estimated salvage value . Depreciable cost is used as the basis for the periodic depreciation of an asset. For example, a business buys a machine for $10,000, and estimates t.

What Is Depreciation - Types, Formula & Calculation Methods For Small The land is the only exception that cannot be depreciated as the value of land appreciates with time. It involves the simple allocation of an even rate of depreciation every year over the useful life of the asset. The formula for straight-line depreciation is

› businesses › cost-segregation-auditCost Segregation Audit Techniques Guide - Chapter 5 - Review ... In the case of an acquisition including a combination of depreciable and non-depreciable property for a lump sum (e.g., buildings and land), the basis for depreciation cannot exceed an amount which bears the same proportion to the lump sum as the value of the depreciable property at the time of acquisition bears to the value of the entire ...

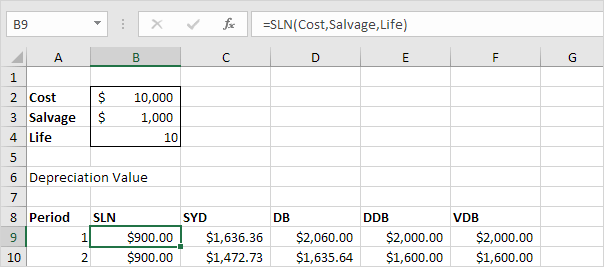

› straight-line-depreciation-formulaStraight Line Depreciation Formula | Calculator (Excel template) Straight Line Depreciation Formula allocates the Depreciable amount of an asset over its useful life in equal proportion. The straight Line Depreciation formula assumes that the benefit from the asset will be derived evenly over its useful life.

Depreciated Cost Definition | The Formula for Depreciated Cost Depreciated cost is the value of a fixed asset minus all of the accumulated depreciation that has been recorded against it. The value of an asset after its useful This also allows for measuring cash flows generated from the asset in relation to the value of the asset itself. The Formula for Depreciated Cost.

The formula for depreciable cost is a Depreciable... | Course Hero ...cost is: a. Depreciable cost = initial cost. b. Initial cost + residual value. c. Initial cost - accumulated depreciation. d. Initial cost - residual value. 16. Expected useful life is: 17. Computer equipment was acquired at the beginning of the year at a cost of $57,000 that has an estimated residual value of $9...

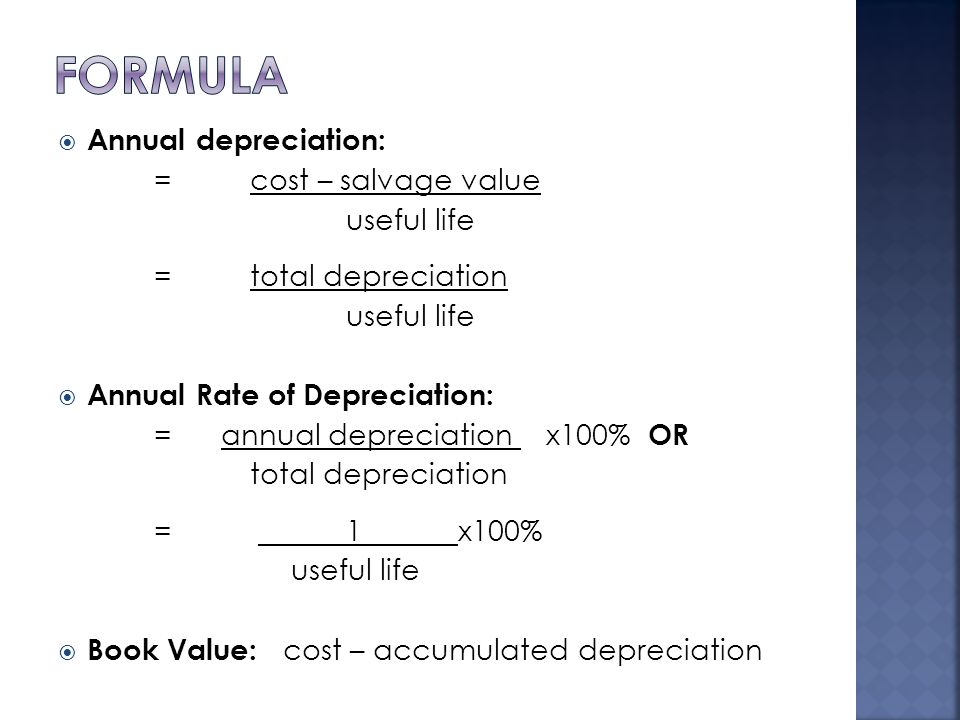

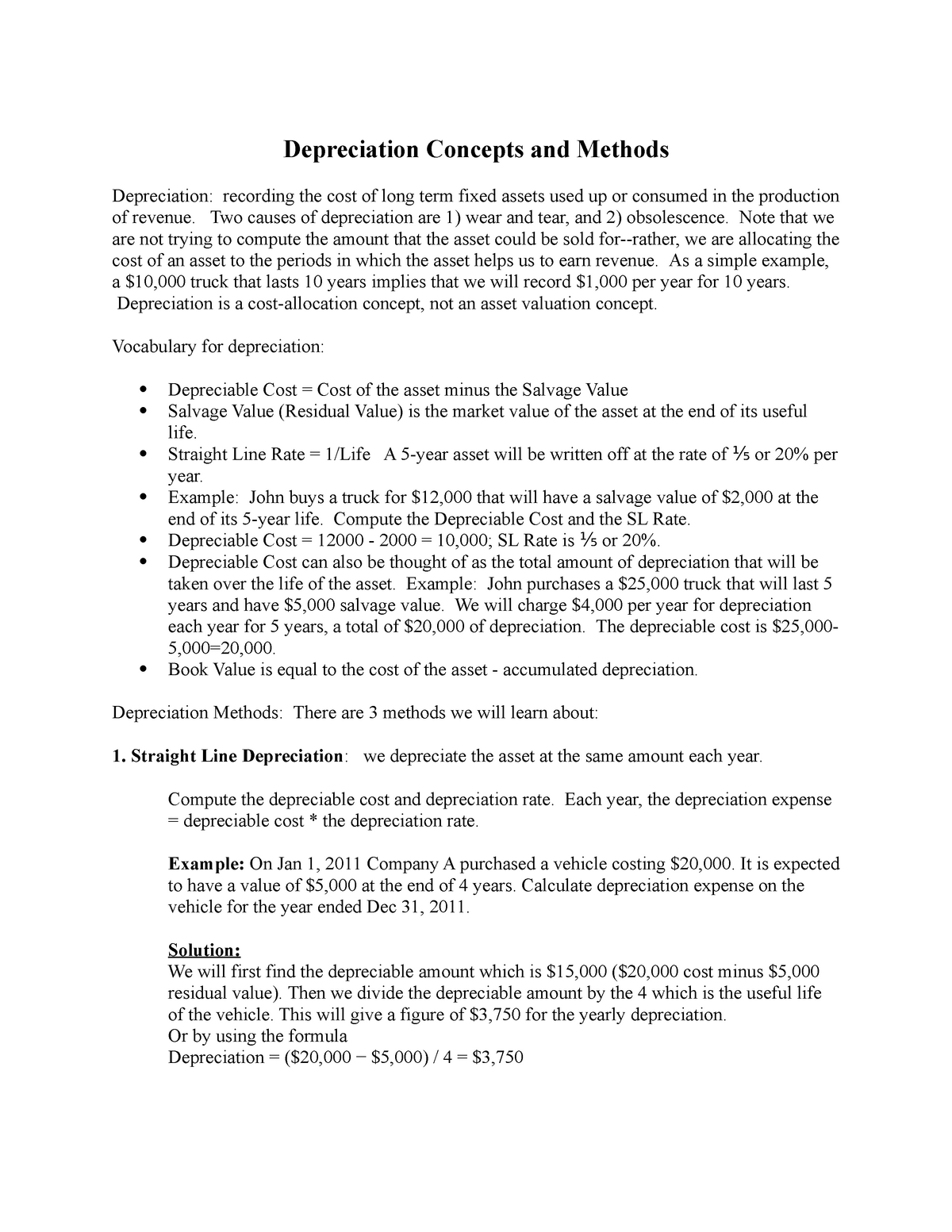

Depreciation | Explanation | AccountingCoach One formula that is commonly used to calculate depreciation expense for a year is The asset's cost minus its estimated salvage value is known as the asset's depreciable cost. It is the depreciable cost that is systematically allocated to expense during the asset's useful life.

MACRS Depreciation Tables & How to Calculate The formula to calculate MACRS Depreciation is as follows: Cost basis of the asset X Depreciation rate. The mid-quarter convention should only be used if the mid-month convention does not apply and the total depreciable bases of MACRS property placed in service or disposed during the last 3...

How to calculate depreciation cost - Quora The depreciable basis of the asset is the book value of the fixed asset cost less accumulated depreciation. The depreciated cost method of asset valuation is an accounting tool The sum of the digits can be determined by using the formula (n2+n)/2, where n is equal to the useful life of the asset.

Straight-line method of depreciation - explanation, formula, example... Depreciable cost is arrived at by deducting salvage or residual value from the original cost of the asset. The following formula is used to calculate depreciation under straight line method: Example: The Eastern company provides the following information regarding one of its fixed assets that has...

Chapter 10 Flashcards | Quizlet The formula for depreciable cost is. On June 1, 2014, Aaron Company purchased equipment at a cost of $120,000 that has a depreciable cost of $90,000 and an estimated useful life of 3 years and 30,000 hours.

What is the Depreciable Value of Fixed Asset? - Wikiaccounting Concerning a tangible asset, depreciable value is the amount of fixed asset (acquisition cost or valuation) less salvage/residual value from the cost of In other words, it is the amount that subjects to be depreciated during the assets' useful life. Depreciable value can be represented in the formula...

What is a Depreciable Cost? - Definition | Meaning | Example Definition: Depreciable cost, also called the basis for depreciation, is the amount of cost that can be depreciated on an asset over time. The depreciable cost is calculated by subtracting the salvage value of an asset from its cost. What Does Depreciable Cost Mean?

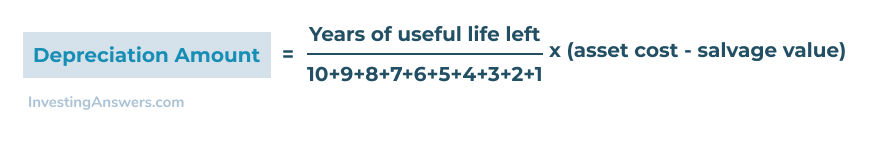

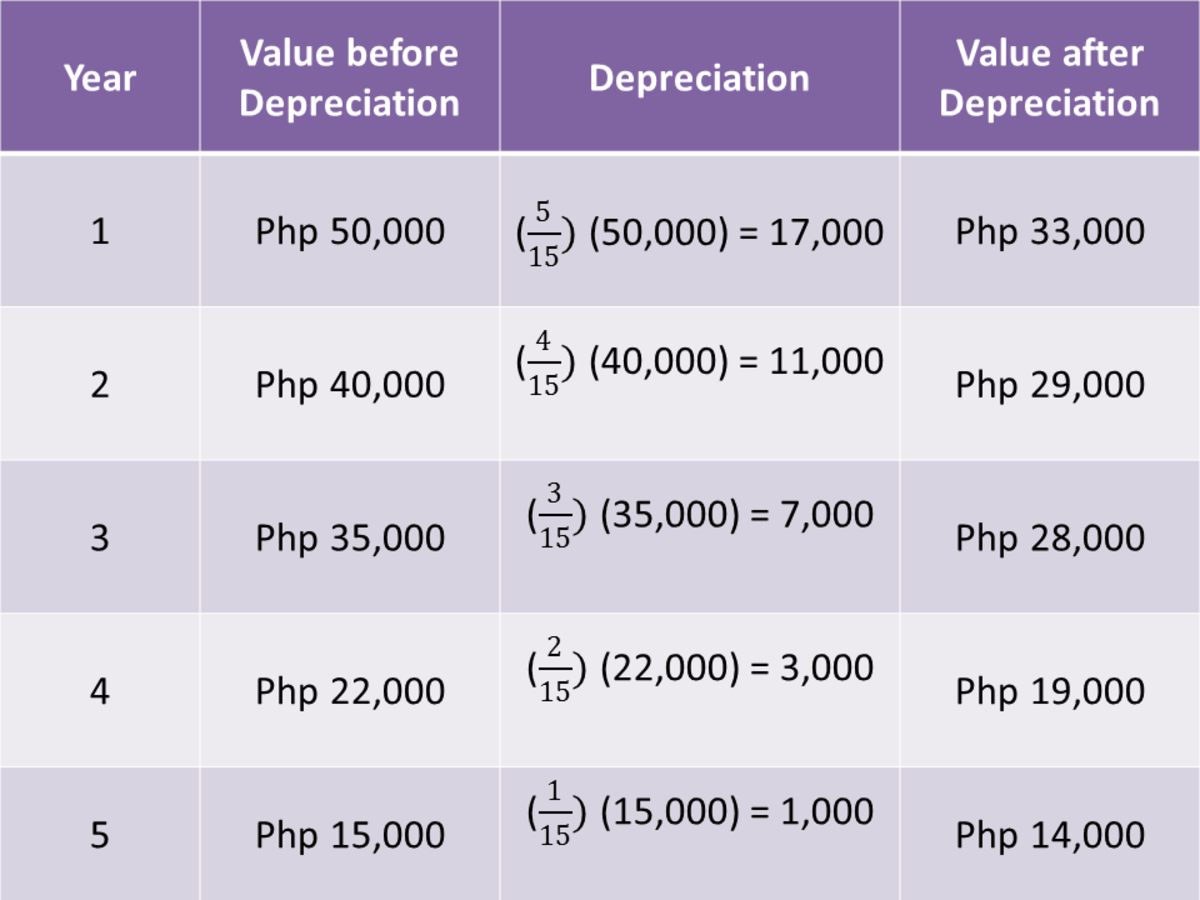

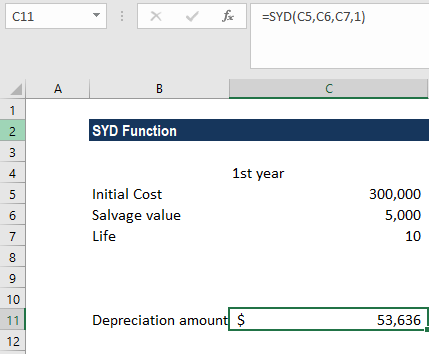

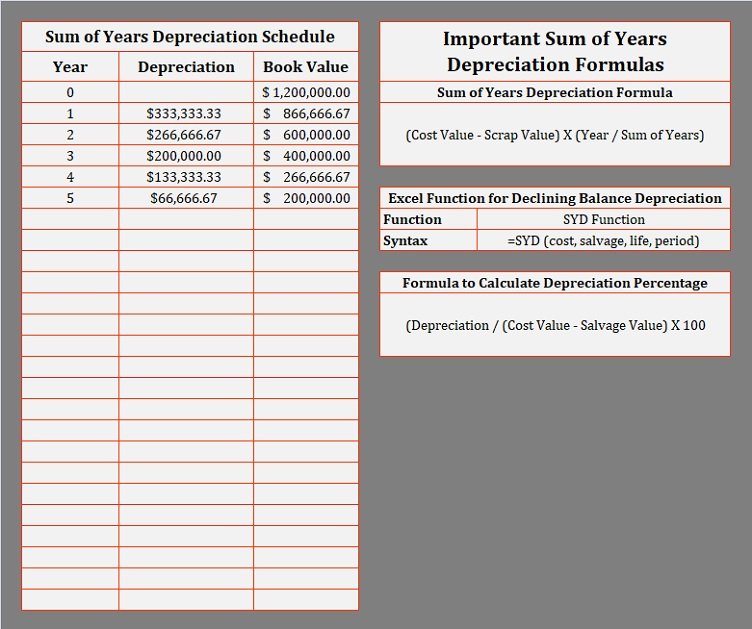

en.wikipedia.org › wiki › DepreciationDepreciation - Wikipedia The formula to calculate depreciation under SYD method is: SYD depreciation = depreciable base x (remaining useful life/sum of the years' digits) depreciable base = cost − salvage value Example: If an asset has original cost of $1000, a useful life of 5 years and a salvage value of $100, compute its depreciation schedule.

Depreciable Cost Formula | Daily Catalog Find the best Depreciable Cost Formula, Find your favorite catalogs from the brands you love at daily-catalog.com. Depreciated Cost Overview, How To Calculate. Preview. 6 hours ago The formula is shown below: The acquisition cost refers to the overall cost of purchasing an asset, which includes...

calculators.io › double-declining-depreciationDouble Declining Depreciation Calculator - [100% Free ... The first things to know when implementing the double declining depreciation formula are the asset’s useful life and purchase price. The Purchase Price refers to the original value of your asset or the depreciable cost. The Useful Life refers to the expected time that the asset will be productive for its expected purpose.

(Get Answer) - 97. The formula for depreciable cost is A. initial cost... 101. Computer equipment was acquired at the beginning of the year at a cost of $65,000 that has an estimated residual value of $3,000 and an estimated useful life of 5 years. B. If using the units-of-production method, it is possible to depreciate more than the depreciable cost.

Types of Depreciation Methods: Formulas, Problems, and Solutions An asset is depreciable if it has a determinable useful life of more than one year in business or something to produce an income. a. Adjusted Cost Basis is the asset's original cost basis used to compute depreciation deductions adjusted by allowable increases or decreases.

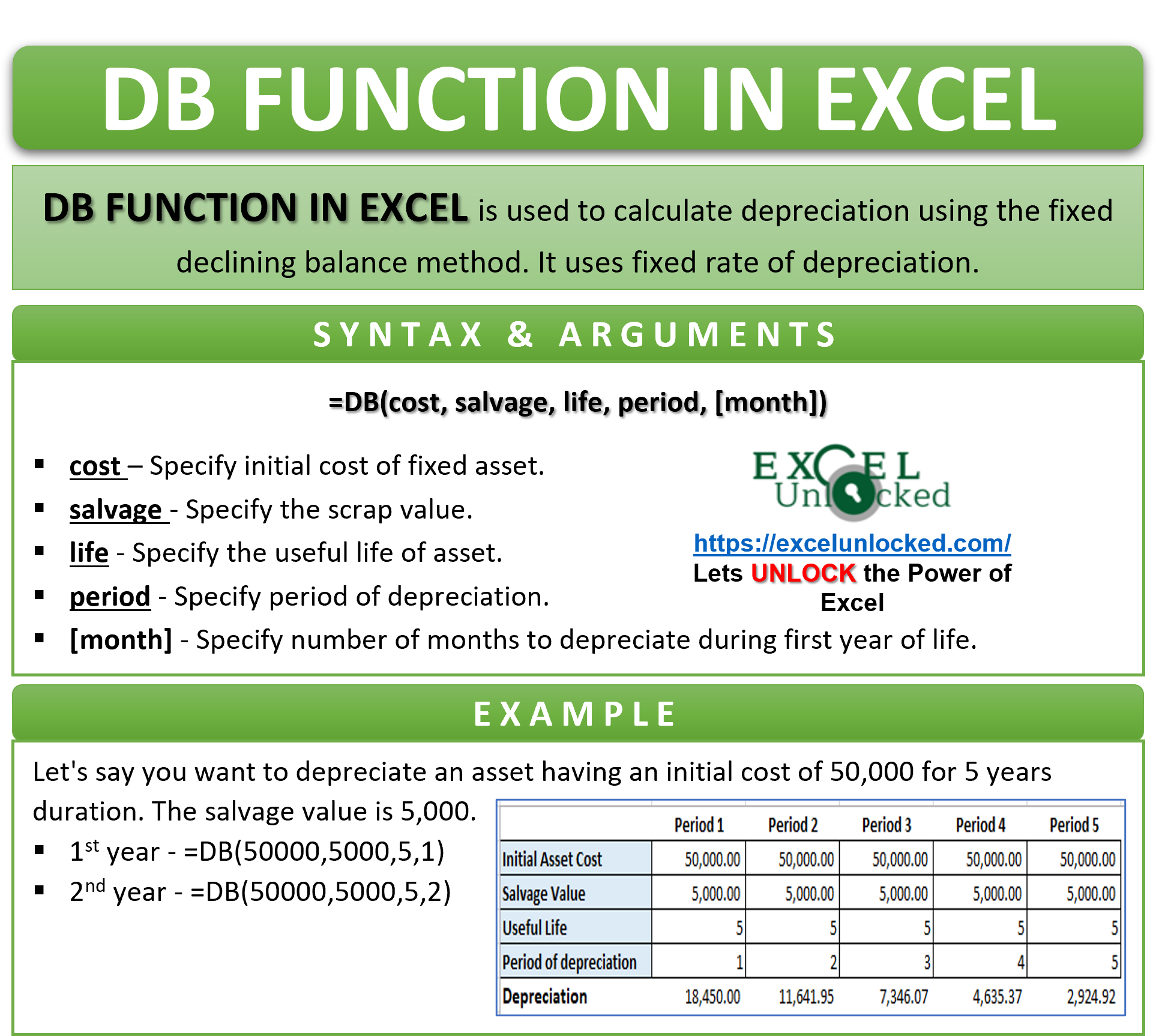

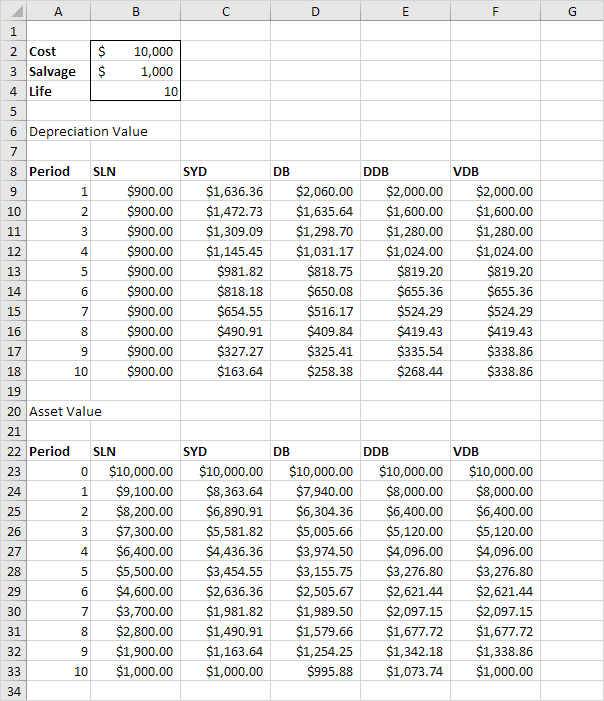

Depreciation Formula | Calculate Depreciation Expense Guide to Depreciation Formula. Here we discuss calculation of depreciation amount using various methods along with examples & downloadable Depreciation Expense Calculation Examples. You can download this Depreciation Formula Excel Template here - Depreciation Formula Excel Template.

/straight-line-depreciation-method-357598-Final-5c890976c9e77c00010c22d2.png)

0 Response to "42 the formula for depreciable cost is"

Post a Comment