40 national pension scheme

National Pension Scheme (NPS) - What is NPS, Contribution ... The National Pension Scheme also known as National Pension System is opened to all the employees from the public sector, private sector, and even the unorganized sector except for those who work in the Armed Forces. National Pensions Scheme - Mauritius (a) The National Pensions Act also provides for the payment of contributions on a voluntary basis by self-employed and non-employed persons. Contributions may be paid in multiples of five rupees, the minimum amount of contributions being Rs 170 a month and the maximum amount Rs 990 a month.

Defined Benefit Pensions Explained [2022] - National ... Learn about how defined benefit pension schemes work in Ireland. We explore the best options for DB scheme holders and best practices.

National pension scheme

› offering › nps-national-pension-schemeNational Pension Scheme (eNPS): Online NPS Scheme & Tax ... National Pension Scheme (eNPS): It is a govt sponsored pension scheme with tax benefits under section 80C. Open your NPS account online with HDFC securities and financially secure your retirement life. National Pension Scheme - INSIGHTSIAS National Pension System (NPS) is a government-sponsored pension scheme. It was launched in January 2004 for government employees. However, in 2009, it was opened to all sections. The scheme allows subscribers to contribute regularly in a pension account during their working life. Benefits of the National Pension Scheme (NPS) National Pension Scheme or NPS, a government-run investment scheme, gives the subscriber the choice to set the favored portion to different asset classes. The subscriber can either apply for an NPS account by visiting a Point of Presence (PoP) or do it online through the e-NPS site. It was initially launched for government employees in 2004 and extended out to the general public in 2009.

National pension scheme. PDF National Pension System (NPS) National Pension System (NPS) NPS, regulated by PFRDA, is an important milestone in the development of a sustainable and efficient voluntary defined contribution pension system in India. It has the following broad objectives: y To provide old age income y Reasonable market based returns over the long term National Pension System - Retirement Plan for All ... The National Pension System (NPS) was launched on 1st January, 2004 with the objective of providing retirement income to all the citizens. NPS aims to institute pension reforms and to inculcate the habit of saving for retirement amongst the citizens. Initially, NPS was introduced for the new government recruits (except armed forces). › Personal-Banking › accountNPS (National Pension Scheme) - Open NPS Account Online ... National Pension System - NPS. National Pension System (NPS) is a voluntary, defined contribution retirement savings system. This retirement scheme is designed to facilitate a regular income post retirement and is based on the unique Permanent Retirement Account Number (PRAN) which is allotted to every individual that applies for the same. byjus.com › free-ias-prep › national-pension-schemeNational Pension Scheme (NPS) - Benefits, Features & More ... The National Pension System (NPS) is a pension scheme sponsored by the government that was started in 2004 for all government employees. The scheme was made open to all citizens in 2009. It is a voluntary and long-term retirement scheme. It is regulated by the Pension Fund Regulatory and Development Authority (PFRDA) and Central Government.

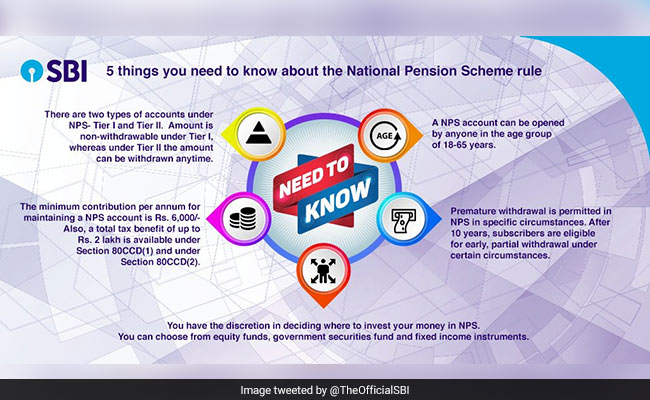

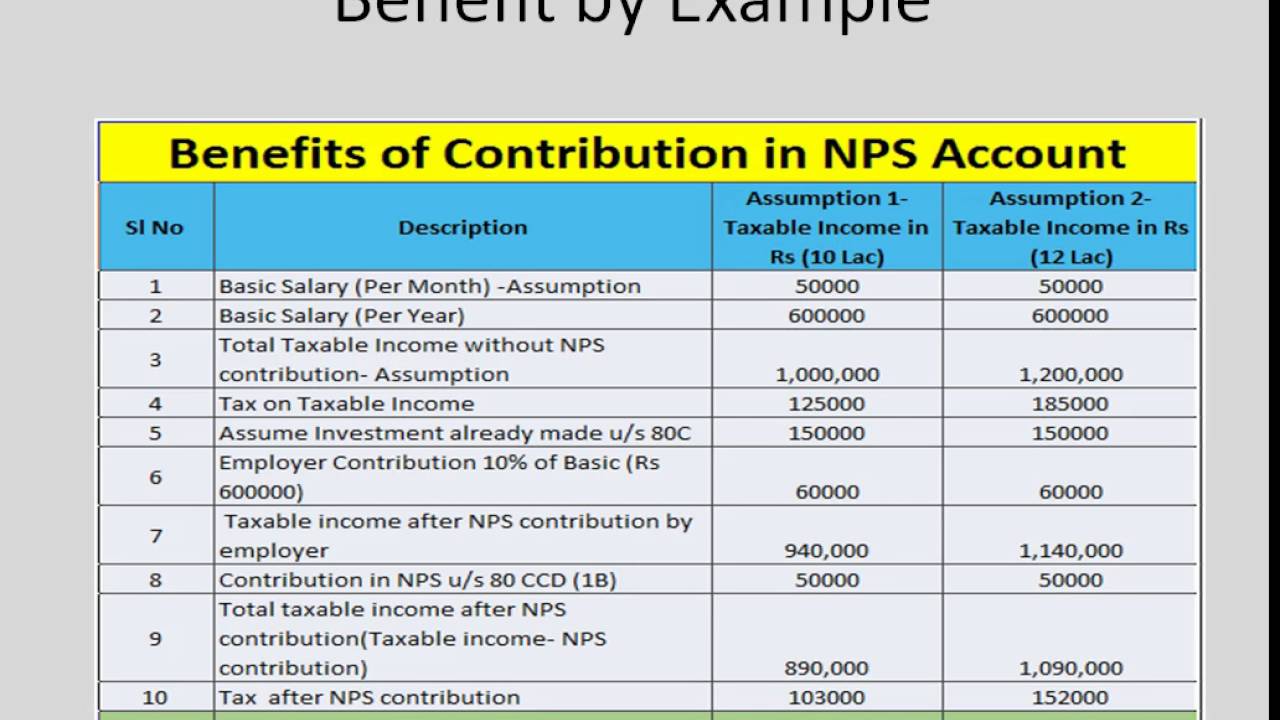

National Pension Scheme-Features, Benefits, Taxation ... The National Pension Scheme tax benefits are considered to be attractive for investors. National Pension Scheme Tax Benefit allowed. Under Section 80CCD 1 (B) Individuals investing in Tier I NPS account can claim a tax benefit of INR 50,000 over and above the INR 1,50,000 exemption which falls under Section 80C. NPS - Personal Banking - SBI National Pension System (NPS) is a defined contribution pension system introduced by the Government of India as a part of Pension Sector reforms, with an objective to provide social security to all citizens of India. It is administered and regulated by PFRDA. Features of NPS scheme Tier I - Pension account (Mandatory A/C - Tax benefit available) cleartax.in › s › nps-national-pension-schemeNPS, National Pension Scheme - ️What is NPS ️Account Opening ... Tax exemption: Up to Rs 2 lakh p.a.(Under 80C ...Minimum NPS contribution: Rs 500 or Rs 500 or ...Maximum NPS contribution: No limitStatus: Default7 steps · 18 mins · Materials: Internet Conection, Mobile or Computer1.In order to log into your NPS account, you must have a 12-digit Permanent Retirement Account Number (PRAN). Submit the necessary documentation on the NSDL website or at the Point of Presence (POP) service providers to avail PRAN: the eNPS login page: you are a first time visitor and don’t remember the password, click on the ‘Generate/Reset password’ option at the bottom of the page. National Pension Service Sells 1,781 Shares of Adobe Inc ... National Pension Service lowered its position in Adobe Inc. (NASDAQ:ADBE - Get Rating) by 0.3% in the third quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission. The fund owned 631,399 shares of the software company's stock after selling 1,781 shares during the period. Adobe accounts for 0.7% of […]

NPS - India Post National Pension System (NPS) is a voluntary retirement savings scheme laid out to allow the subscribers to make defined contribution towards planned savings thereby securing the future in the form of Pension. It is an attempt towards a sustainable solution to the problem of providing adequate retirement income to every citizen of India. NPS Eligibility - National Pension System Eligibility The prime objective of the scheme is to provide all citizens of India with an attractive long term savings avenue to plan for retirement through safe and reasonable market based returns. The account can be opened by all Indian Citizens between 18 to 60 Years. Steps for online account opening: KFintech National Pension System account login allows NPS subscribers to access account online to check pension fund balance and other NPS details. NPF and the Imperative of Contributory Pension - National ... For upward of eighteen years, the Nigeria Police Force (NPF) has sought to be exempted from the Contributory Pension Scheme (CPS) in addition to making, among other things, provision for its retirees to withdraw at least 75% from the Retirement Savings Account (RSA) while also criminalising undue delay in the payment of pension to the […]

NPS: National Pension System, Benefits of NPS, NPS Tax ... National Pension Scheme (NPS) is a government-sponsored pension scheme. It was launched in January 2004 for government employees. However, in 2009, it was opened to all sections. The scheme allows subscribers to contribute regularly in a pension account during their working life.

Pension Calculator - NPS Trust This pension calculator illustrates the tentative Pension and Lump Sum amount an NPS subscriber may expect on maturity or 60 years of age based on regular monthly contributions, percentage of corpus reinvested for purchasing annuity and assumed rates in respect of returns on investment and annuity selected for.

NPS Calculator - Calculate National Pension Scheme Online Monthly Pension: Rs.34,613.03Amount Invested (sans interest): Rs.2,880,000Annual Pension: Rs.415,356.40Withdrawable Amount on Maturity: Rs.3,461,3...6 steps1.Date of Birth (DOB)- Based on your DOB the NPS Pension calculator will compute the number of years you will need to contribute to the scheme in order to accumulate the desired amount after retirement.2.Investment Amount- Enter the amount that you want to contribute per month.3.Expected Return on Investment (ROI)- Select the return on investment which you desire to get.

› about › other-businessNational Pension Scheme - UTI Asset Management National Pension System (NPS) is a ‘Government of India’ initiative with an objective of Development of a sustainable and efficient voluntary defined contribution Pension System in India. It is regulated by Pension Fund Regulatory and Development Authority (PFRDA).

Social Assistance Programme (NSAP)|Ministry Of Rural ... Indira Gandhi National Disability Pension Scheme (IGNDPS): BPL persons aged 18-59 years with severe and multiple disabilities are entitled to a monthly pension of Rs. 300/-. National Family Benefit Scheme (NFBS): Under the scheme a BPL household is entitled to lump sum amount of money on the death of primary breadwinner aged between 18 and 64 ...

NPS Account - National Pension Scheme Features & Benefits ... National Pension System (NPS) is a retirement benefit Scheme introduced by the Government of India to facilitate a regular income post retirement to all the subscribers. PFRDA (Pension Fund Regulatory and Development Authority) is the governing body for NPS. Salient Features & Benefits

eNPS - National Pension System eNPS - National Pension System Guidelines for Online Registration NPS Trust welcomes you to 'eNPS' ,which will facilitate:- Opening of Individual Pension Account under NPS (only Tier I / Tier I & Tier II) by All Indian Citizens (including NRIs) between 18 - 70 years

NPS - National Pension Scheme (एनपीएस), Open NPS Account ... Introduced in 2004, The National Pension System (NPS) was previously available only for the Central Government employees. However, it was made available for ...Interest rate: 8% to 12% p.aMaturity Amount: Depends on the investment a...Investment Amount: Starting at Rs.250Tenure: Can invest till the age of 65 yearsWhat are the KYC documents required to enroll for NPS through SBI?How to check the status of your NPS account in SBI?

National Pension Scheme - The Economic Times National Pension System is a government sponsored pension scheme.It is a contribution based scheme where the amount of pension to be received by you in the future depends on the amount of corpus accumulated at the time of scheme's maturity.

National Pension Scheme (NPS) Calculator: Online NPs ... National Pension Scheme (NPS) Calculator helps you to know the monthly pension and lump sum amount that you may get when you retire at the age of 60. NPS Calculator enables you to decide your monthly contribution towards NPS accordingly. Investment in NPS offers tax benefit under Section 80CCD and is an attractive retirement solution.

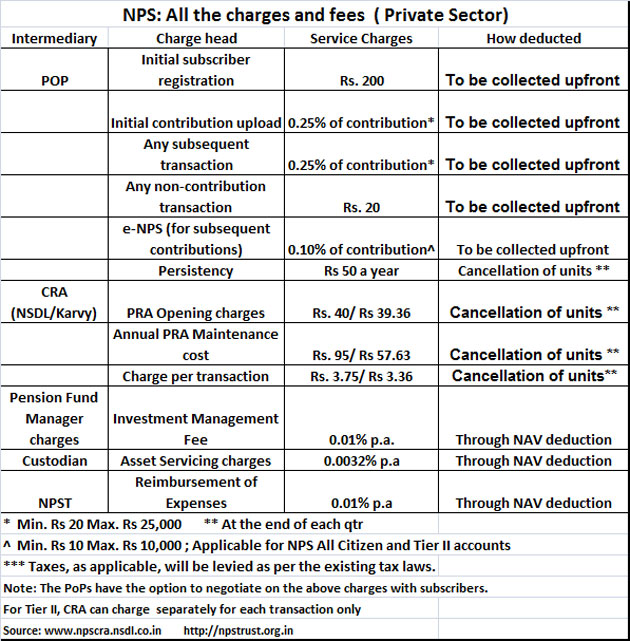

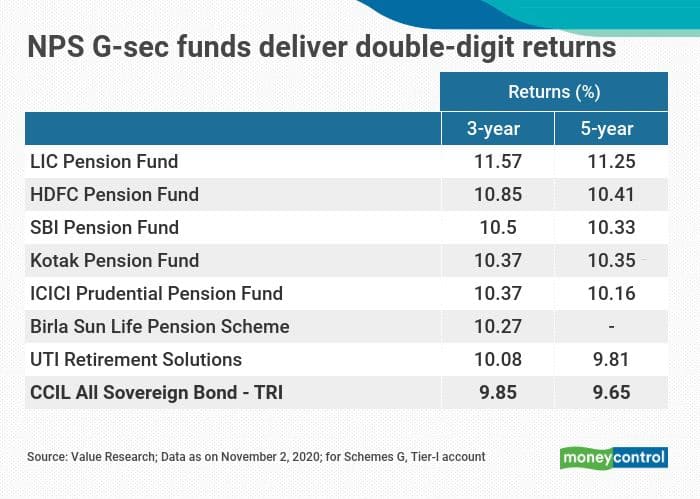

NPS: National Pension Schemes Eligibility, Types, Calculator National Pension Schemes is one of the cheapest investment products available with extremely low charges. Pension Fund Manager fees are capped at 0.01% compared to 2-2.5% for mutual funds. Other charges in the NPS are also extremely low as you will notice from the table below. NPS Withdrawals

Indira Gandhi National Old Age Pension | Local Self ... Criteria for Allotting Indira Gandhi National Old Age Pension Scheme. Applicant must be a destitute. No person shall be eligible for the pension, if he/she is in receipt of any other Social Welfare pensions. No one of their to look after him/her. No person shall be eligible if he/she resorts to habitual begging. No person shall be eligible for the pension, if he/she is admitted to …

National Pension Scheme Authority - Guaranteed Social Security National Pension Scheme Authority - Guaranteed Social Security Online Queueing Appointment Booking e-Services Login Home The Director General About Us Notifications Pension Information Downloads Contact us OSS Help Mandate, Vision & Mission N A P S A i s c o m m i t t e d t o s e r v i n g y o u b e t t e r . You, Your Spouse & Children Benefit

How to Invest in National Pension Scheme - BankBazaar The National Pension Scheme allows online investment. It is handled by the Pension Fund Regulatory and Development Authority (PFRDA). Both employees and employers contribute towards this retirement benefit scheme. NPS scheme is particularly designed to encourage systematic savings among employees of both central and state and among common ...

taxguru.in › income-tax › income-tax-benefitsIncome Tax benefits under National Pension Scheme (NPS) Sep 01, 2020 · National Pension Scheme Tier II- Tax Saver Scheme, 2020 [Section 80C(2)(xxv)] With effect from Assessment year 2020-21, Tax benefit of Section 80C will be available to the Government employee if, they contributes towards Tier-II of NPS.

National Pension Scheme (NPS) - Features, Advantages & Tax ... Registration for the scheme can be done in the following steps. Step 1 - Go to the eNPS portal available at the official website of the National Pension System. Step 2 - Choose your subscriber type from the available options 'Individual Subscriber' and 'Corporate Subscriber'. Step 3 - Choose your suitable residential status.

National Pension System - Wikipedia The National Pension System ( NPS) is a voluntary defined contribution pension system in India. National Pension System, like PPF and EPF is an EEE (Exempt-Exempt-Exempt) instrument in India where the entire corpus escapes tax at maturity and entire pension withdrawal amount is tax-free.

NPS: National Pension System | NPS Tax Benefits | Top ... National Pension System (NPS) is a defined contribution pension system. NPS schemes have two options. Tier 1 and Tier 2. Tier 1 has a longer lock in period (15 years for even partial withdrawal) as...

Benefits of the National Pension Scheme (NPS) National Pension Scheme or NPS, a government-run investment scheme, gives the subscriber the choice to set the favored portion to different asset classes. The subscriber can either apply for an NPS account by visiting a Point of Presence (PoP) or do it online through the e-NPS site. It was initially launched for government employees in 2004 and extended out to the general public in 2009.

National Pension Scheme - INSIGHTSIAS National Pension System (NPS) is a government-sponsored pension scheme. It was launched in January 2004 for government employees. However, in 2009, it was opened to all sections. The scheme allows subscribers to contribute regularly in a pension account during their working life.

› offering › nps-national-pension-schemeNational Pension Scheme (eNPS): Online NPS Scheme & Tax ... National Pension Scheme (eNPS): It is a govt sponsored pension scheme with tax benefits under section 80C. Open your NPS account online with HDFC securities and financially secure your retirement life.

%20-%20Tier%20one%20&%20Tier%20two-originalImg-bdb03cbb-0e41-4c19-a182-d1d45097baaa.png)

0 Response to "40 national pension scheme"

Post a Comment