39 long-term tangible assets include

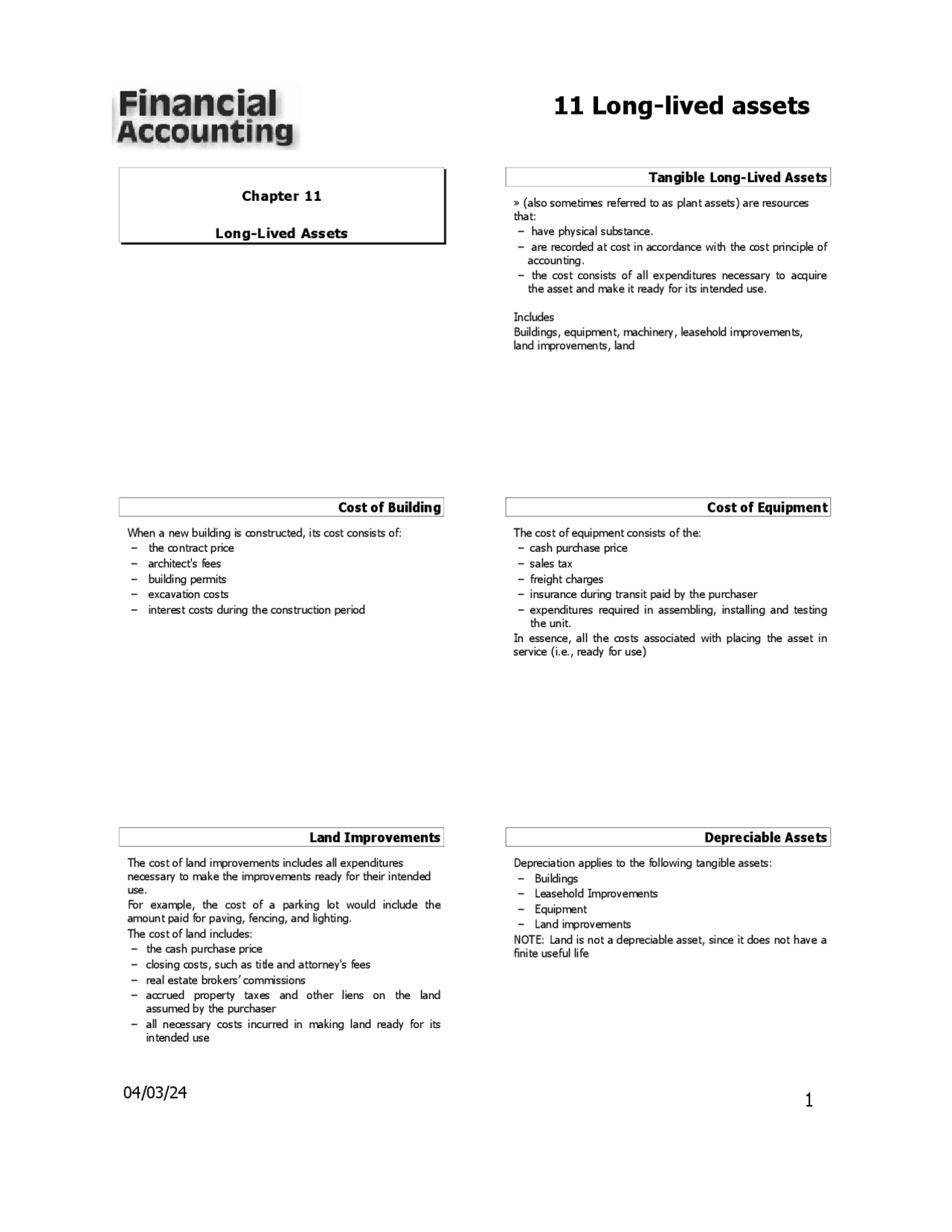

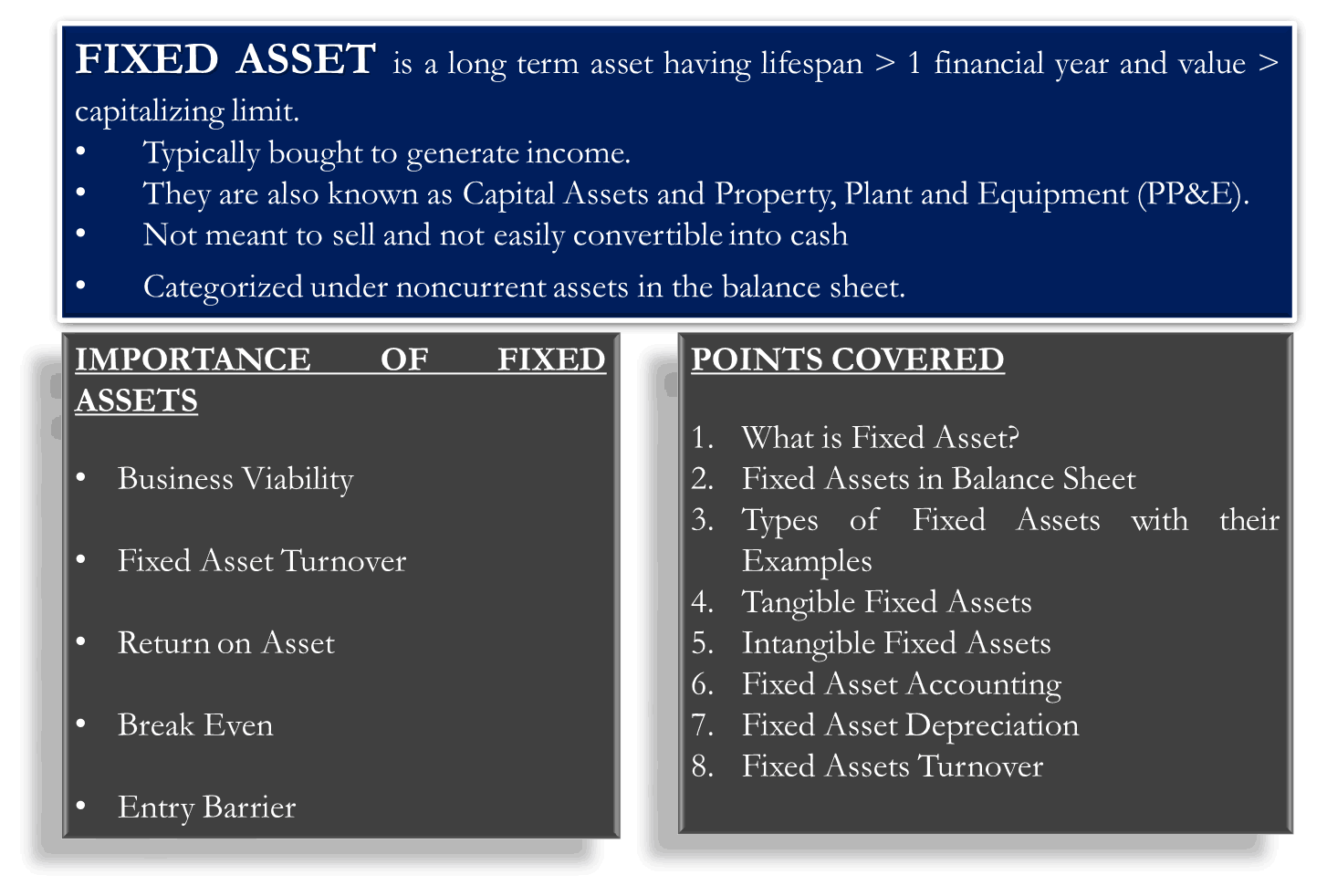

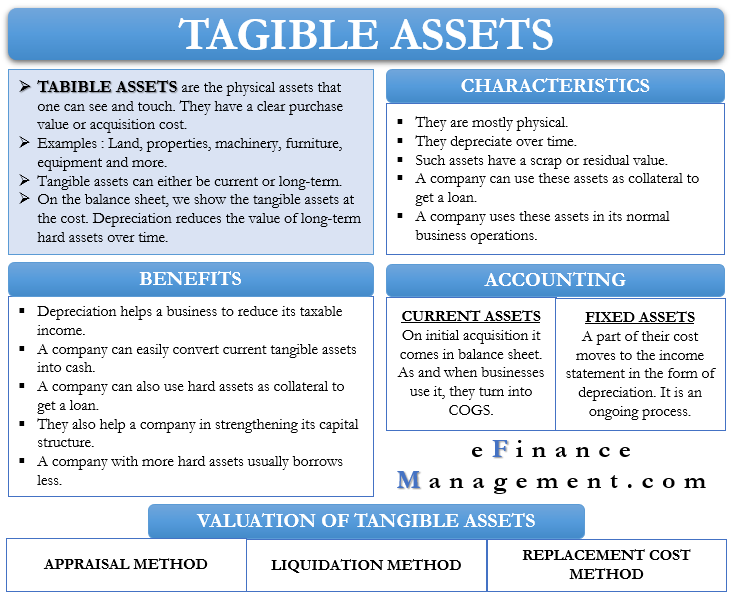

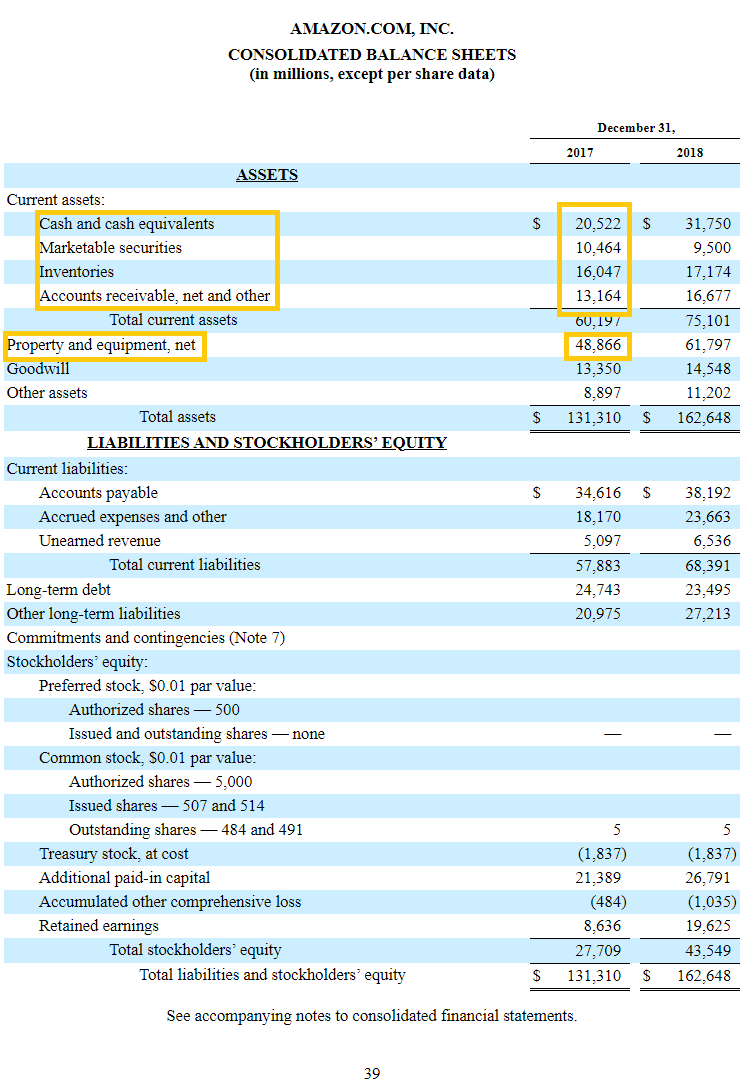

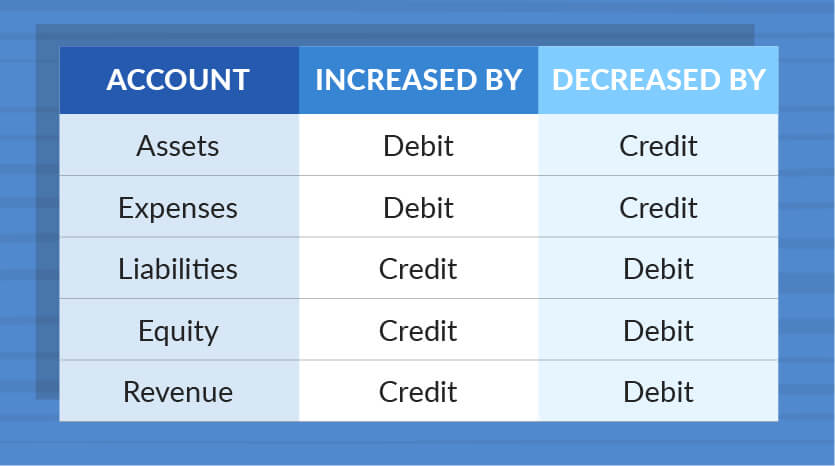

Accounting chapter 10.docx - Accounting chapter 10 FIXED ... Accounting chapter 10 FIXED ASSET - a long-term asset that is tangible like equipment, machinery, building and land. PPE- plant property and equipment. Characteristics Physically exists, tangible Owned and used by the company to produce products and are not available for resale Classification of costs How to determine classification of a cost and how it is recorded Investment- long lived ... Is furniture a long term asset? These are tangible or long term assets that include buildings, land, fixtures, equipment, vehicles, machinery and furniture. As opposed to current assets, furniture and other kinds of fixed assets are not used for liquidation purposes to satisfy a debt, to pay wages or to aid day to day business operations financially.

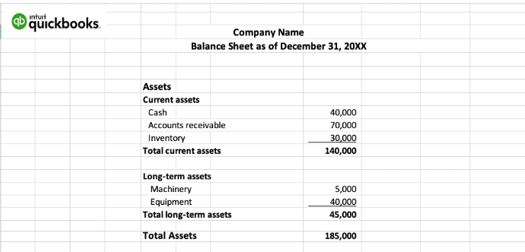

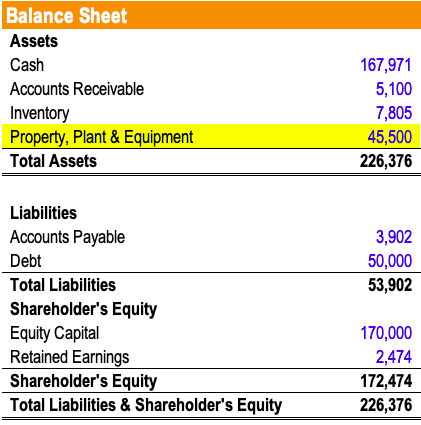

› balance-sheet-newBalance Sheet - Long-Term Assets | AccountingCoach The first long-term asset Investments will include amounts such as the following: Long-term investments in investment securities, real estate, or other businesses Property that is in the process of being sold Cash surrender value of life insurance policies owned by the company Bond sinking funds and other assets restricted for a long-term purpose

Long-term tangible assets include

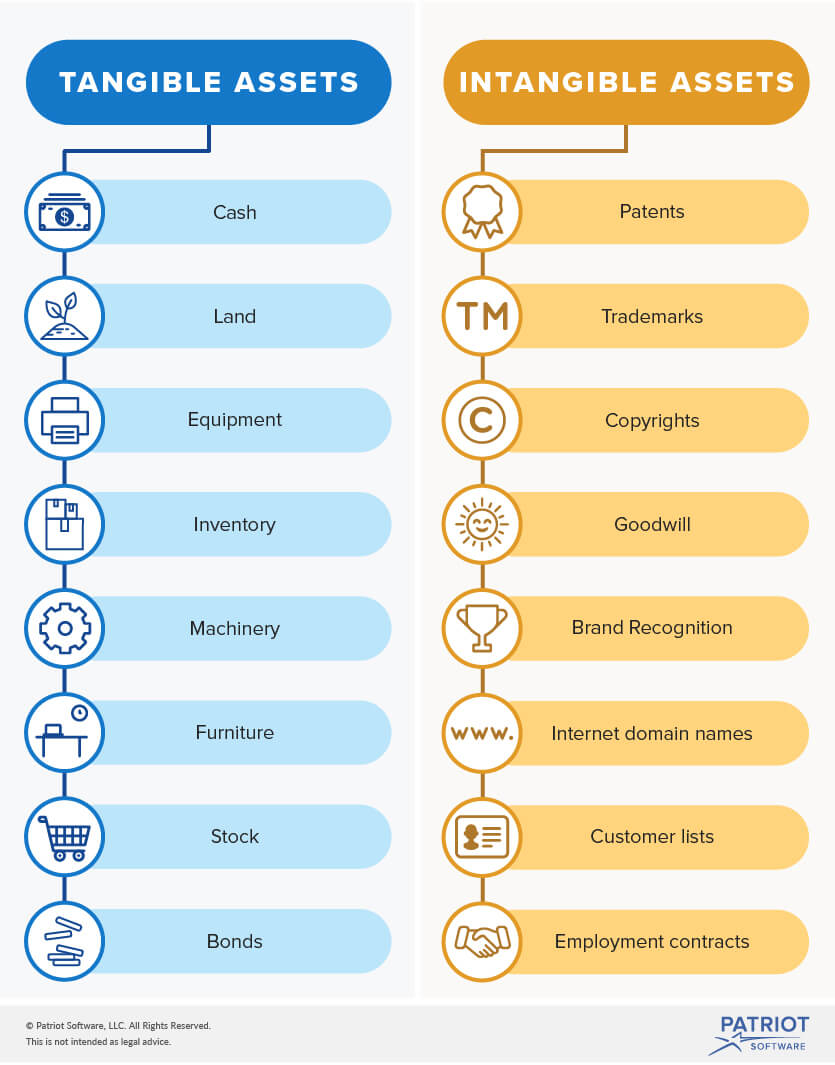

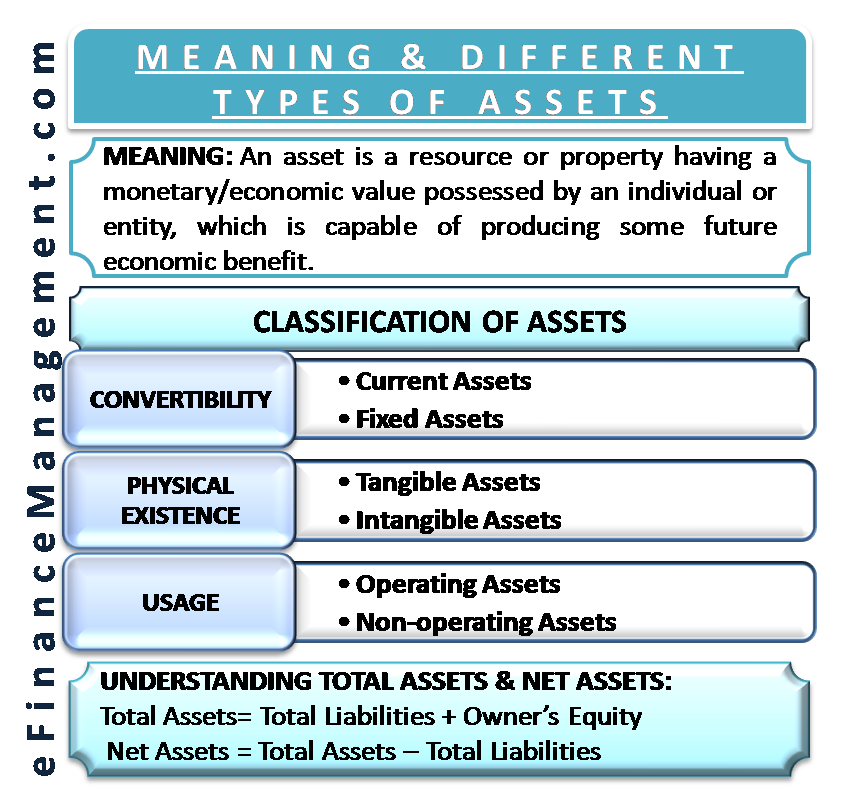

3.6 Tangible v Intangible Assets - Financial and ... 3.6 Tangible v Intangible Assets Assets are items a business owns. 3 For accounting purposes, assets are categorized as current versus long term, and tangible versus intangible. Assets that are expected to be used by the business for more than one year are considered long-term assets.They are not intended for resale and are anticipated to help generate revenue for the business in the future. Would be classified as a long-term operational asset? Some examples of long-term assets include: Fixed assets like property, plant, and equipment, which can include land, machinery, buildings, fixtures, and vehicles. Long-term investments such as stocks and bonds or real estate, or investments made in other companies. Trademarks, client lists, patents. What are examples of long-term investments? simplicable.com › new › asset5 Types of Asset - Simplicable Sep 06, 2015 · 1. Tangible Assets Tangible assets are any assets that have a physical presence. Examples include cash, stocks, bonds, property, buildings, equipment, inventory, precious metals and art.

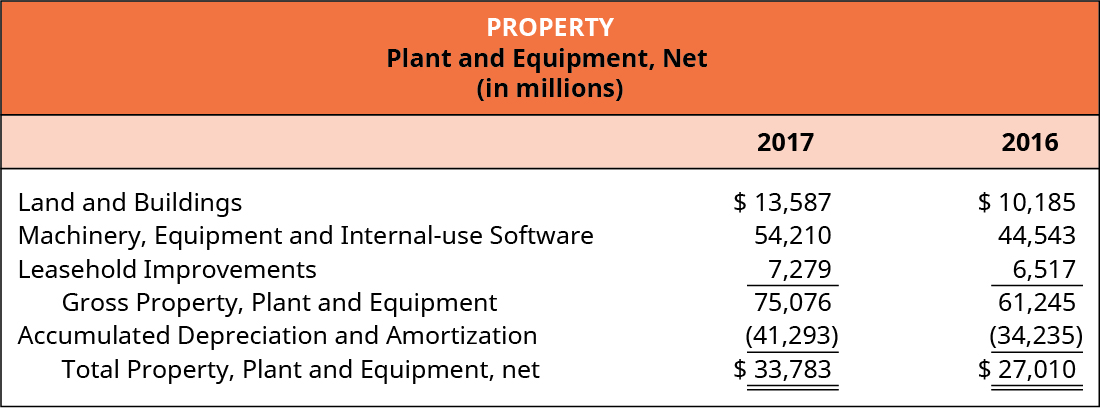

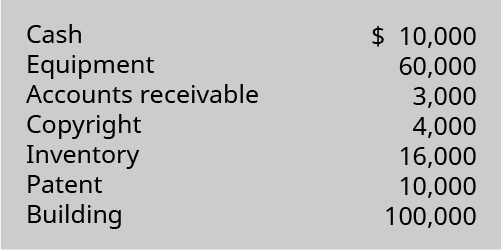

Long-term tangible assets include. What are Tangible Assets? - Definition | Meaning | Example What Does Tangible Assets Mean? What is the definition of tangible asset? These resources can be divided into two main categories: current and fixed. Current assets are resources that will be consumed in the current period like inventory. Fixed assets are long-term resources that will provide value for future periods to come. 11.1 Distinguish between Tangible and Intangible Assets ... Long-term tangible assets are listed as noncurrent assets on a company's balance sheet. Typically, these assets are listed under the category of Property, Plant, and Equipment (PP&E), but they may be referred to as fixed assets or plant assets. What are Long-Term Assets? | Tangible and Intangible long ... Tangible long-term asset is an asset that has physical presence and it is an asset that the firm will acquire for more than one year. Examples of long-term tangible assets in a business include computer equipment, furniture, machinery, buildings, and land. › long-term-investments-on-theLong-Term Investment Assets on the Balance Sheet Oct 31, 2021 · Defining Long-Term Investment Assets . A firm invests for the long term to help them sustain profits now and into the future. These long-term investments could include stocks or bonds from other firms, Treasury bonds, equipment, or real estate. On the other hand, current assets are often liquid assets.

Tangible Asset Definition - Investopedia Long-term assets, sometimes called fixed assets, comprise the second portion of the asset section on the balance sheet. These assets include things like real estate properties, manufacturing... Types of Assets - List of Asset Classification on the ... If assets are classified based on their physical existence, assets are classified as either tangible assets or intangible assets. 1. Tangible Assets Tangible assets are assets with physical existence (we can touch, feel, and see them). Examples of tangible assets include: Land Building Machinery Equipment Cash Office supplies Inventory What Are Long-term Assets Examples? What are the two major categories of long-term assets? There are two major types of long-term assets: tangible and non-tangible. Tangible assets include fixed assets, such as buildings and equipment. Intangible assets includes non-physical resources and rights that a firm deems useful in securing an advantage in the marketplace. Tangible Assets (Definition, Examples, List) | How to Value? List of Tangible Assets Examples Property - Property includes land, building, office furniture, etc Plant - Plant is the physical space where the workers work or provide services Equipment - This refers to the machinery, vehicles and other tools & equipment used to produce

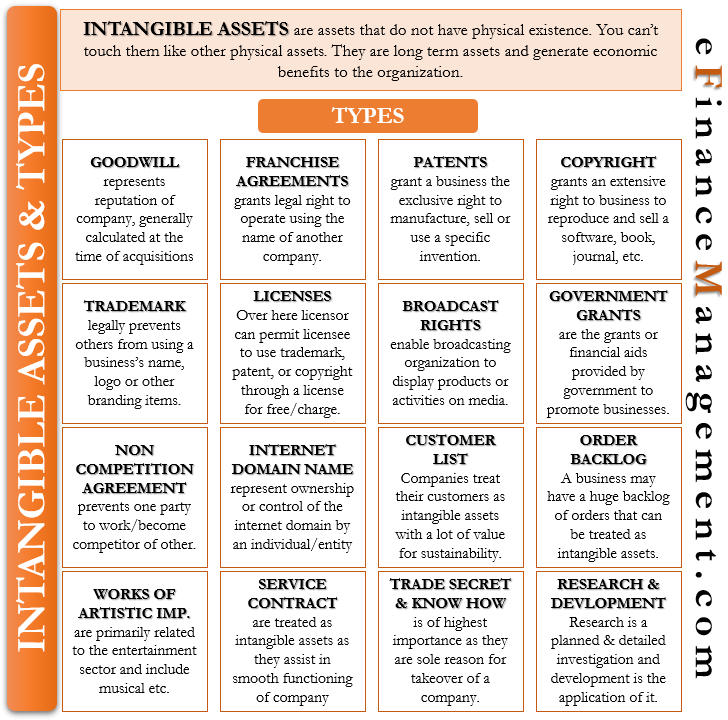

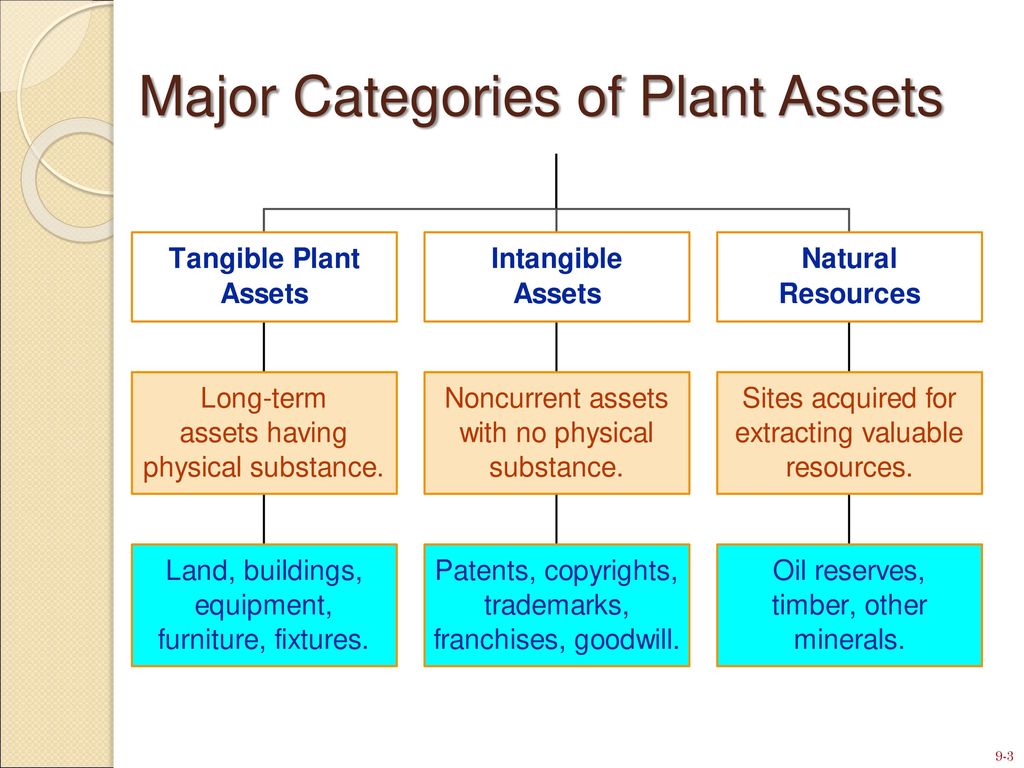

How to include rent on a balance sheet ⋆ Accounting Services Fixed assets most commonly appear on the balance sheet as property, plant, and equipment (PP&E). Other noncurrent assets include long-term investments and intangibles. A fixed asset is a long-term tangible piece of property or equipment that a firm owns and uses in its operations to generate income. › terms › lLong-Term Assets Definition - investopedia.com Long-term assets can include tangible assets, which are physical and also intangible assets that cannot be touched such as a company's trademark or patent. There is no standardized accounting... Distinguish between Tangible and Intangible Assets ... 66 Distinguish between Tangible and Intangible Assets . Assets are items a business owns. 1 For accounting purposes, assets are categorized as current versus long term, and tangible versus intangible. Assets that are expected to be used by the business for more than one year are considered long-term assets.They are not intended for resale and are anticipated to help generate revenue for the ... Intangible Assets - Business Accounting Intangible assets exist in opposition to tangible assets, which include land, vehicles, equipment, and inventory. Tangible assets. Other noncurrent assets include long-term investments and intangibles. Intangible assets are fixed assets, meant to be used over the long-term, but they lack physical existence.

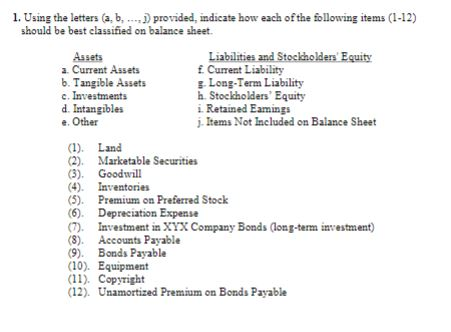

Accounting Ch 7 Quiz Flashcards | Quizlet Long-term tangible assets include buildings. land. equipment. Which of the following items are intangible assets? patents. trademarks. goodwill. The issues that are important for tangible and intangible assets, include determining: how to record the disposal of the asset what amounts to include in the cost

Long Term Assets Definition & Examples - Current Vs Long ... Long-term assets can include tangible assets, which are physical and also intangible assets that cannot be touched such as a company's trademark or patent. There is no standardized accounting formula that identifies an asset as being a long-term asset. But, it is commonly assumed that such an asset must have a useful life of more than one year.

Long Term Assets - Accounting Test Prep Long-term Tangible Assets Called "property plant and equipment" or "fixed assets" Physical substance, you can touch them 3 kinds of L/T tangible assets 1) Land - not depreciated 2) Buildings, fixtures, equipment, autos, computers - depreciated 3) Natural resources - metals, timber, oil - depleted Intangible - Grants a right to the owner

› ask › answersHow Do Tangible and Intangible Assets Differ? Apr 27, 2021 · The long-term assets are recorded below "Total Current Assets." The company's tangible assets are recorded as property plant, and equipment (highlighted in blue), which totaled $253 billion as of ...

Tangible Assets - Money-zine The financial accounting term tangible asset is used to describe assets that have physical substance. Examples of tangible assets include cash, accounts receivable, inventory, land, buildings / real estate, and machinery. Explanation Tangible assets are usually long term assets, and can be found on a company's balance sheet.

Property, Plant, and Equipment (PP&E) Definition Property, plant, and equipment (PP&E) are long-term assets vital to business operations. Property, plant, and equipment are tangible assets, meaning they are physical in nature or can be touched ...

Tangible Assets - Learn How to Classify and Value Tangible ... What are Tangible Assets? Tangible assets are assets with a physical form and that hold value. Examples include property, plant, and equipment . Tangible assets are seen and felt and can be destroyed by fire, natural disaster, or an accident.

Accounting Ch.7 Tangible Assets Flashcards - Quizlet Tangible Assets. include land, land improvements, buildings, equipment, and natural resources. Property, plant, and equipment. consists of land, land improvements, buildings, equipment, and natural resources. Record long-term asset. as its cost plus all expenditures necessary to get the assets ready for use.

www2.gov.bc.ca › tangible-capital-assetsCPPM Procedure Chapter I: Tangible Capital Assets - Province ... For all tangible capital assets (including large EDP mainframe and LAN systems, heavy equipment, buildings, highways, bridges, etc.) that are acquired or constructed with a completion date of the first of the month or prior to the sixteenth, amortization will be taken for the current month.

What Are Long Term Assets? (with pictures) A long term asset can either be tangible or intangible. Tangible assets are something that can be physically touched. Some examples of tangible assets include buildings, land, equipment, tools, and anything else that has a physical stance. The intangible assets are what is presented on paper. The value of these assets are based on current ...

› legal-encyclopedia › free-booksWhat Property to Put in a Living Trust - Nolo A living trust isn't the only way to save money on probate. For some assets, you may decide to use other probate-avoidance devices instead. And even if some property does have to go through regular probate, attorney and appraisal fees generally correspond roughly to the value of the probated property, so the cost will be relatively low.

Chapter 8 ACCY1 Questions Flashcards - Quizlet Chapter 8 ACCY1 Questions. Why is land classified separately from other tangible long-term assets? Land is classified separately from property, plant and equipment because it is not subject to depreciation. Land is considered to have an indefinite life; it is not destroyed through the process of its use.

Chapter 7- Long Term Assets Flashcards - Quizlet Long-term tangible assets include. Equipment, Land, Buildinngs. Which statement is true about the straight-line method of depreciation? It allocates an equal amount of depreciation to each year the asset is used. The original cost of the asset less the accumulated depreciation is the.

Ch.6 Long Term Assets Flashcards - Quizlet Long term tangible assets used in the operation of the business such as machinery, equipment, buildings, and vehicles Includes long term tangible assets, long term intangible assets Tangible Assets Assets whose value is attributed to their physical substances ex) productive assets, lands, and natural resources Intangible Assets

simplicable.com › new › asset5 Types of Asset - Simplicable Sep 06, 2015 · 1. Tangible Assets Tangible assets are any assets that have a physical presence. Examples include cash, stocks, bonds, property, buildings, equipment, inventory, precious metals and art.

Would be classified as a long-term operational asset? Some examples of long-term assets include: Fixed assets like property, plant, and equipment, which can include land, machinery, buildings, fixtures, and vehicles. Long-term investments such as stocks and bonds or real estate, or investments made in other companies. Trademarks, client lists, patents. What are examples of long-term investments?

3.6 Tangible v Intangible Assets - Financial and ... 3.6 Tangible v Intangible Assets Assets are items a business owns. 3 For accounting purposes, assets are categorized as current versus long term, and tangible versus intangible. Assets that are expected to be used by the business for more than one year are considered long-term assets.They are not intended for resale and are anticipated to help generate revenue for the business in the future.

/ExxonLongtermAssets2018-5c5485414cedfd0001efdb2c.jpg)

:max_bytes(150000):strip_icc()/ExxonLongtermAssets2018-5c5485414cedfd0001efdb2c.jpg)

/GettyImages-923167626-1425a7c433954d43a6bd05221eb373e6.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_How_Current_and_Noncurrent_Assets_Differ_Oct_2020-01-e74218e547134e3db0ac9e9a7446d577.jpg)

/dotdash_Final_Property_Plant_and_Equipment_PPE_Sep_2020-01-dd61e2f2fdb7481d81e95bc90b5c61d8.jpg)

0 Response to "39 long-term tangible assets include"

Post a Comment